$196M security breach exposed infrastructure weaknesses

$70M hack due to weak risk systems

Client migration to platforms with advanced algo tools

$2-3M cost, 18+ months timeline, high technical risk

$22B → $44B by 2027 (15.9% CAGR)

50-70% of volume already algorithmic

Virtu Financial acquired ITG, MarketAxess acquired Pragma

No-code bots, copy-trading, backtesting now mass market requirements

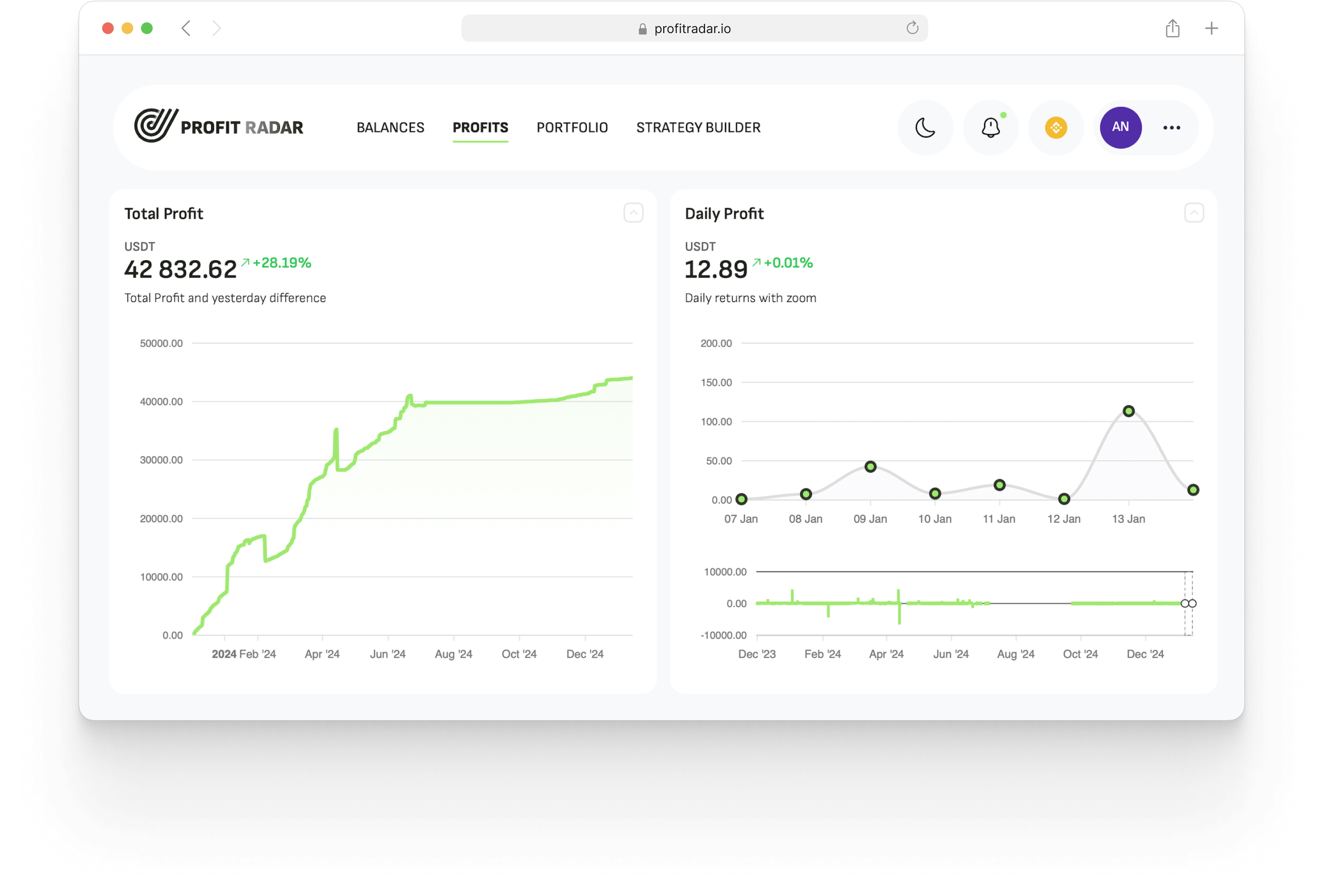

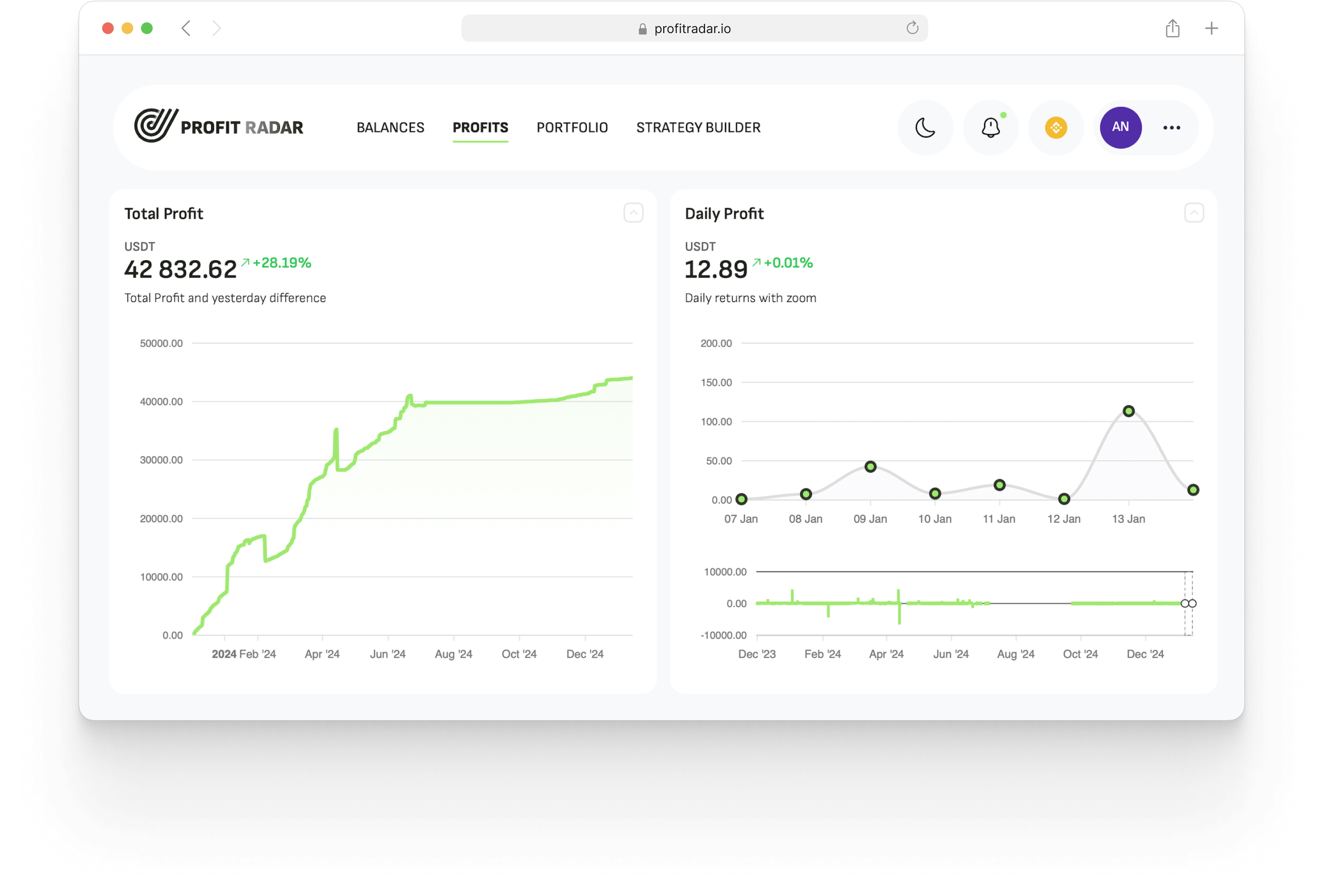

No-code interface democratizing institutional-grade algorithmic trading for mass market

Genetic optimization algorithms with portfolio validation against years of historical data

2 years production use. Social trading platform with strategy libraries and portfolio intelligence

3-layer protection: position, account, and system-level controls with FIA compliance

Production-validated on Binance, OKX, Kraken. Ready for traditional markets expansion

50K+ lines source code, 3-month integration support, zero vendor dependencies

960 days continuous operation • Zero critical failures

Trading Positions

Volume Processed

Concurrent Accounts

Peak Ops/Minute

Major Exchanges

Critical Failures

Examples: Regional leaders, emerging market platforms

Budget: $10-15M acquisition capability

Driver: Client retention, competitive differentiation

Examples: Interactive Brokers competitors

Budget: $15-20M acquisition capability

Driver: Algo capabilities gap, client demands

Focus: $200M+ AUM institutions

Budget: $8-12M acquisition capability

Driver: Proprietary infrastructure, independence

Focus: Social trading startups, eToro competitors

Budget: $12-16M acquisition capability

Driver: Complete infrastructure, proven copy-trading system

Complete source code, 3-month integration support, documentation

Marketing, partnerships, deal execution

2.5-3x return, family office acquisition

3.5-4x return, Tier-2 exchange acquisition

4-5x return, traditional broker acquisition

Ready for immediate technical validation and due diligence

Live system demonstration within 48 hours. Complete production data access for qualified investors.

Source code repository, 960 days operational data, team knowledge transfer protocols.

Built 2 years early, market demand materialized 2024-2025, peak opportunity window 2026-2027.

4-6 weeks from technical review to transaction completion. Flexible deal structuring available.

Complete technology transfer with full due diligence materials available